Essential Accounting and Tax Insights for Your Business Journey in Japan: Navigating Corporate Tax and Compliance

Welcome to the dynamic world of Japanese accounting and tax services! Whether you’re a seasoned player in Japan’s market or a newcomer gearing up for expansion, understanding the intricate financial landscape here is crucial.

This blog is your roadmap, crafted by the experts at weConnect, to navigate the complexities of Japan’s unique accounting and tax systems.

Whether you’re a local enterprise or an international business stepping into Japan for the first time, delve into the nuances of Japanese Generally Accepted Accounting Principles (J-GAAP) and International Financial Reporting Standards (IFRS), and explore the diverse accounting systems suitable for your business.

Navigating Japan’s tax system can seem daunting, with its distinct corporate, consumption, and income tax structures. But breaking down these components offers insights into tax incentives, exemptions, and essential compliance requirements to ensure smooth expansion into the Japanese market.

At weConnect, we understand that entrusting your accounting and tax needs to an outside provider can bring a host of concerns. That’s why we are here to reassure you with our personalized, flexible, and custom-built services that are designed to feel like an extension of your in-house team. Contact us today to speak with our Japan experts.

Understanding Japan’s Unique Financial Landscape

Navigating Japan’s finance world? It’s all about getting to grips with its one-of-a-kind rules, especially in accounting.

Think of the Japanese Generally Accepted Accounting Principles (J-GAAP) and the International Financial Reporting Standards (IFRS) as the big players here. Why? Because they’re the ones shaping how businesses handle their financial reporting and management in Japan.

Japanese Generally Accepted Accounting Principles (J-GAAP)

J-GAAP is a set of standards that govern financial reporting in Japan. These principles are tailored to the specific economic and business environment of Japan, making them quite distinct from those in other countries.

For local businesses, adhering to J-GAAP is crucial for accurate financial reporting and compliance. For international businesses operating in Japan or considering entry into the Japanese market, understanding J-GAAP is essential for aligning their financial practices with local requirements and expectations.

International Financial Reporting Standards (IFRS)

On the other hand, IFRS, which are adopted in many countries worldwide, offer a more global perspective on financial reporting.

The adoption of IFRS in Japan signifies a move towards international financial practices, providing a common language for financial affairs globally. This is particularly relevant for multinational companies and those involved in foreign direct investment in Japan.

Japan is aligning its accounting standards with the IFRS to support clear and consistent global financial practices, which is vital for businesses around the world.

The interaction between J-GAAP and IFRS in Japan creates a vibrant financial scene. It’s important to understand these standards and their effects on both local and international companies for effective financial management and compliance. This knowledge is crucial for meeting legal requirements and making wise financial decisions.

Next, let’s discuss how to select the appropriate accounting system that complies with these standards and how to navigate Japan’s complex tax laws.

Choosing the Right Accounting System for Your Business in Japan

Selecting the best accounting system is a pivotal decision for businesses setting up or already operating in Japan. businesses operating in Japan. This choice can significantly influence how seamlessly a company can integrate into the Japanese financial framework and simultaneously report financial insights to company stakeholders.

Let’s compare popular global accounting systems like Xero, Quickbooks, NetSuite, Microsoft Dynamics and SAP with Japanese systems such as Yayoi Kaikei and Kanjo Bugyo.

Global Accounting Systems (Xero, Quickbooks, NetSuite, Microsoft Dynamics, SAP)

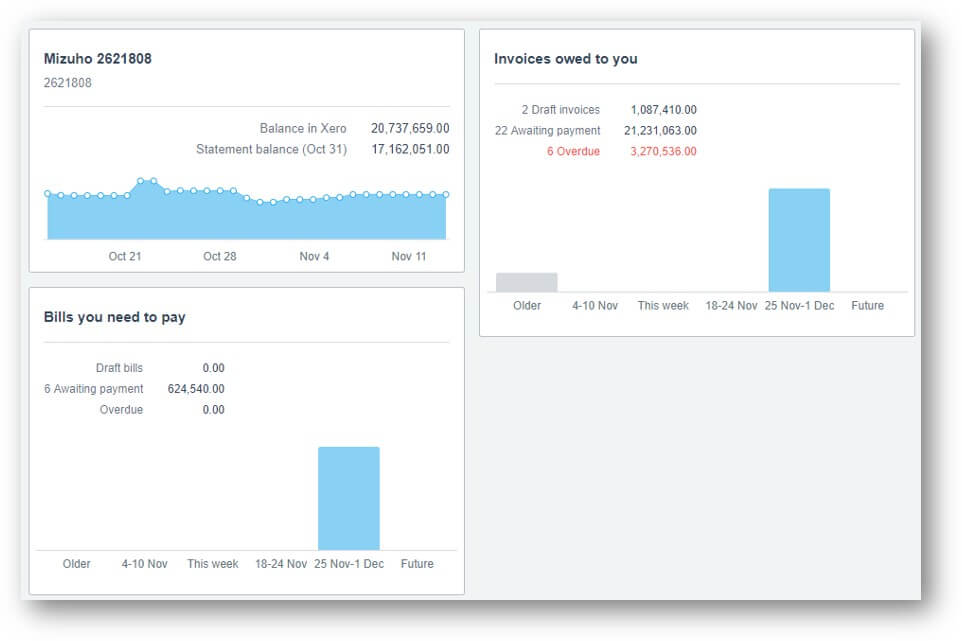

Internationally known platforms bring many advantages to businesses in Japan. Tools such as Xero & Quickbooks stand out for their easy-to-use designs, cloud technology, and wide range of features suited for different business requirements. NetSuite, Microsoft Dynamics and SAP are known for their robust financial management capabilities and are typically used by companies who are ready to intimately integrate their business processes with financial and enterprise resource planning (ERP) systems.

These systems are perfect for businesses needing the flexibility and ease of accessing their financial information in English anywhere in the world while also keeping their business compliant with Japan’s accounting and tax regulations.

Japanese Accounting Systems (Yayoi Kaikei, Kanjo Bugyo)

Local Japanese systems are made to fit Japan’s specific accounting and tax rules and needs. For businesses mainly working in Japan in Japanese language, these local systems can provide a more connected solution to the tax office, but for clients in need of English cloud access with the ability to connect their Japan financials with global financials, they will not be able to meet these needs.

Selecting the right accounting software, whether international or local, hinges on the specific requirements of your business.

For those already engaged with global business service vendors or operating across multiple countries, international accounting systems like Xero, Quickbooks, NetSuite, Microsoft Dynamics and SAP could be advantageous due to their ability to comply with international standards, local tax rules and connect multiple entities for a consolidated financial view.

On the other hand, if your operations are concentrated primarily in Japan and you do not need English, choosing a local system tailored to the unique accounting practices of Japan might be more beneficial.

When it comes to following Japanese laws, international systems like Xero, NetSuite and the others mentioned have big advantages. Their ability to adapt and follow international standards makes them a reliable option for businesses operating both in Japan and around the world. Just know that they are 100% compliant in Japan and if someone tells you differently they just don’t know or are lying to you.

Navigating Japan’s Tax System

Knowing Japan’s tax system is crucial for businesses in Japan. It’s a complex system with different taxes like corporate, consumption, and income tax. We’ll look into these main parts and talk about the tax breaks, exceptions, and rules businesses need to know.

Corporate Tax in Japan

Corporate tax in Japan is a major consideration for any business entity. The rate and regulations surrounding this tax can vary based on factors such as the size of the company, registered capital amount, number of employees, office space size and the amount of taxable income.

It’s important for businesses to stay on top of the current corporate tax rate in Japan and understand how it applies to their specific operations. Timely compliance with corporate tax requirements is crucial to avoid penalties and maintain good standing in the Japanese business environment.

Japan is the land of punctuality. If you miss a deadline, the tax office does not have a heart and does not make exceptions no matter what the excuse. Some of our clients, when COVID started in 2020, couldn’t finish their financials on time for their tax return and lost their blue tax form status with the tax office. That meant that they couldn’t carry forward losses booked in 2020 to future fiscal years. For some clients that meant missing out on hundreds of millions of yen in deductions. In Japan it is honestly better to file an incorrect or incomplete tax return on time and then, once you have everything organized, file an updated filing.

Consumption Tax

The Japanese consumption tax is a form of value-added tax (VAT) levied on most goods and services. Understanding the scope of this tax, along with the applicable rate, is important for businesses as it affects pricing strategies and overall revenue. Compliance in this area involves accurate calculation and timely remittance of the tax collected from consumers.

Income Tax

Income tax in Japan applies to both individuals and businesses. For companies, this involves paying taxes on the income generated within Japan. It’s important for businesses, especially those with international operations, to understand how income tax is calculated and the various deductions and exemptions that may apply.

In addition to these primary taxes, businesses should be aware of the various tax incentives and exemptions available in Japan. These can include reductions or allowances for specific industries, investment in technology, or contributions to research and development. Navigating these incentives can significantly impact a company’s financial planning and tax liabilities.

Compliance with the Japan tax system is non-negotiable and requires meticulous attention to detail. Failure to comply can lead to severe penalties, including fines and legal repercussions. Therefore, it’s crucial for businesses to have a robust system in place, either in-house or through a reliable tax compliance services partner like weConnect, to manage their tax affairs effectively.

Customized Accounting and Tax Services for Your Business

In the intricate financial terrain of Japan, customized accounting and tax services are not just a luxury – they’re a necessity for business success. weConnect understands this need and offers a comprehensive range of services tailored to the unique requirements of each business. Let’s explore these services and understand how their customization and flexibility can benefit your business.

Bookkeeping Services

Proper bookkeeping is the foundation of sound financial management. weConnect offers meticulous bookkeeping services, along with accounting and integrated payroll services, that ensure your financial records are accurate, up-to-date, and compliant with Japanese regulations.

This includes all aspects of a functioning finance function like managing ledgers, tracking expenses, inventory valuation, sending customer invoices and preparing financial statements. The customization of these services means that whether you are a small startup or a large multinational, your bookkeeping needs are met with the same level of precision and care.

Financial Reporting

Grasping the financial well-being of your company is essential, and weConnect excels in delivering detailed financial reporting services that shed light on your business’s fiscal performance.

These reports are more than just figures; they serve as pivotal instruments for strategic planning, aligned with both local accounting and tax regulations and simultaneously booked in your accounting standard such as IFRS, US-GAAP or this list of international accounting standards.

This part of our service is particularly significant for businesses in need of detailed reporting for stakeholders or overseas parent companies, ensuring clarity and compliance on a global scale.

Tax Services

Navigating corporate tax in Japan requires expertise and precision. weConnect offers specialized tax accounting services, including tax planning, compliance, and consulting. Our tax team are ex-partners of KPMG Japan who left to join the more forward-thinking and technologically focused team at weConnect.

Whether it’s understanding corporate tax implications, managing consumption tax, or ensuring income tax compliance, our tax professionals provide bespoke solutions. These services are designed to not only keep your business compliant but also to identify potential tax savings and incentives.

The flexibility of weConnect’s services means we adapt as your business grows and changes. This bespoke approach ensures that you receive only the services you need, in a way that best suits your business model. Whether it’s through on-demand consulting, ongoing management, or a combination of services, weConnect stands ready to support your business’s financial journey in Japan.

Overcoming Outsourcing Challenges: The weConnect Approach

Outsourcing financial services, especially in a nuanced market like Japan, often brings up concerns regarding control, relationship management, and quality. At weConnect, we recognize these challenges and have developed a robust approach to not only address them but to turn them into strengths. Here’s how weConnect effectively navigates the common hurdles associated with outsourcing.

- Maintaining Control: One of the primary concerns with outsourcing is the potential loss of control over financial processes. weConnect mitigates this by ensuring transparent, constant communication and giving clients full visibility and control over their financial operations. When implementing international systems like Xero, Quickbooks, NetSuite, Microsoft Dynamics, or SAP the client can have their cake and eat it too by receiving finalized reports ready for consolidation within as fast as 1 business day after month-end while also ensuring 100% compliant with Japan regulations.

- Building Strong Relationships: The impersonal nature of traditional outsourcing can hinder the development of meaningful relationships. Recognizing this, weConnect leverages the latest communication platforms to create a more intimate and interactive experience. Tools like Zoom, Microsoft Teams, and Google Hangouts are used to facilitate face-to-face interactions, allowing for a more personal connection and understanding between weConnect’s team and the clients. This approach fosters trust and collaboration, ensuring that the relationship is as strong as it would be with an in-house team.

- English Cloud Accounting Systems: weConnect is the only provider in Japan that has deep expertise in implementing and managing the leading accounting and enterprise resource planning (ERP) systems in Japan including Xero, Quickbooks, NetSuite, Microsoft Dynamics, SAP, Oracle, JD Edwards, Sage, ZOHO, Wave, Hyperion, Odoo, Paprika. weConnect’s ability to manage these systems in Japan give clients a valuable choice of which system they prefer.

- Ensuring Quality of Service: Quality can often be a concern when it comes to outsourcing. weConnect addresses this by employing a team of highly skilled and experienced professionals in the field of finance and tax. This team is not only adept at navigating the complexities of the Japanese market but is also committed to maintaining the highest standards of service. Continuous training and development ensure that the team stays abreast of the latest developments in financial regulations and practices and we maintain an industry leading attrition rate of less than 2%, so our team really is a family that enjoys working together.

Additionally, weConnect’s commitment to continuity of service is a critical aspect of our approach. By assigning a dedicated team and giving clients a single point of contact for each account, we ensure that knowledge and understanding of each client’s business are retained, even if individual team members are unavailable. This approach guarantees consistent quality and uninterrupted service delivery.

In short, unlike many other outsourced accounting firms, weConnect’s approach to overcoming the challenges of outsourcing financial services in Japan is built on ensuring client’s maintain control, fostering strong relationships, implementing cloud systems and delivering unwavering quality. This unique methodology not only addresses common concerns but also adds significant value to their clients’ operations.

Staying Updated with Japanese Financial Regulations

In the ever-evolving landscape of Japanese finance, an integral part of Japan business culture is staying current with financial regulations and tax laws. This isn’t just important; it’s essential for business success. Known for their complexity and frequent updates, these regulations require businesses to remain informed and compliant to navigate the market effectively.

weConnect offers several resources and methods to help you stay on top of these changes. These include:

- Golden Insights: Subscribe to weConnect for the latest updates on Japanese financial regulations and tax laws.

- Seminars and Webinars: Participate in informative sessions conducted by industry experts who provide insights into the latest trends and changes in Japan’s financial world.

- Consultation Services: For more personalized guidance, weConnect’s consultation services offer in-depth analysis and strategies tailored to your business’s specific needs.

Remaining vigilant and informed about changes in regulations with specialized tax compliance services not only helps in maintaining compliance but also in identifying new opportunities and strategies for financial optimization.

Transform Your Financial Strategy with weConnect’s Japan Accounting and Tax Services

Navigating the complex world of accounting and tax services in Japan can be daunting, but with weConnect, you’re not alone on this journey. From understanding Japan’s unique financial standards and choosing the right accounting system for your business, to expertly navigating the tax system and overcoming the challenges of outsourcing – weConnect is your partner in success.

Our tailored approach coupled with our ability to speak from your own company’s context ensures that your business is not just compliant but also positioned to thrive in Japan. With our team of experts and commitment to quality, weConnect is the ideal partner for businesses seeking to navigate the complexities of Japanese finance and need English support. Contact us today to take the next step in managing your accounting and tax needs in Japan.