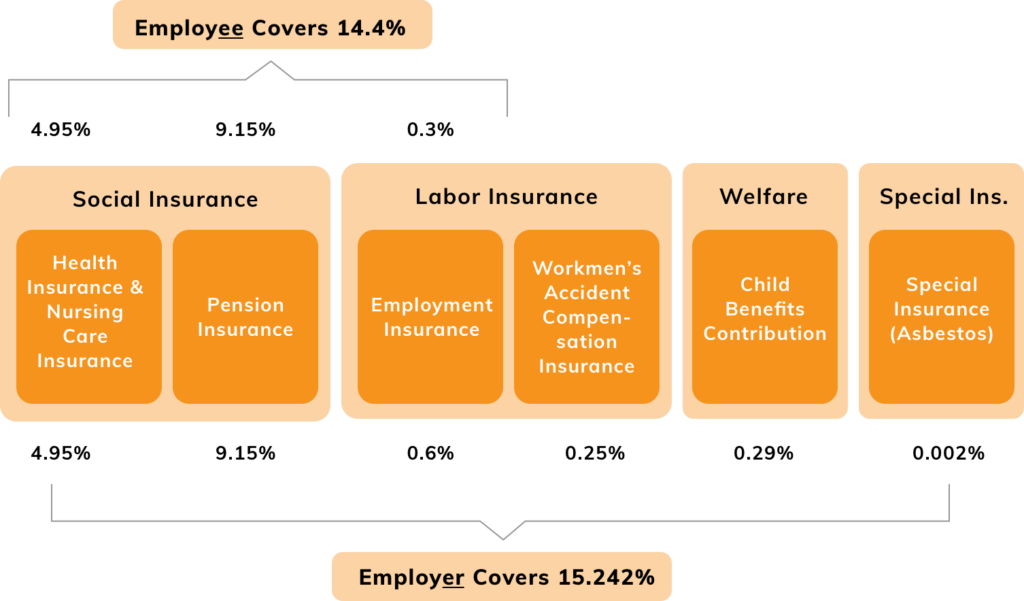

- All companies in Japan hiring full time or eligible employees must enroll into the below “social benefit” schemes

- Benefit premiums are split between employee and employer

- Employee premiums are deducted from gross salary. Employer premiums are additional cost based on gross salary. (e.g. if you pay someone JPY 500,000 per month in gross salary, the company cost approaches JPY 580,000 assuming you, as the employer, offer common non-statutory benefits along with these statutory “social benefits” illustrated below.

*If the employee is 40 years of age or older, the premium rate increases to 5.815% from March 2019 to include Nursing Care Insurance.

**Premium rate for Workmen’s Accident Compensation Insurance is 0.25% minimum. Subject to increase depending on the job’s risk factor.

***information as of December 2019 – please reach out to us for most up to date rates.

If there are any questions about how to hire talent in Japan with or without an entity and ensure these benefits are offered, please reach out to us to speak over a call free of charge. With retention of top bilingual talent in Japan becoming increasingly more competitive, ensuring you properly communicate the benefit package to your candidates is extremely important when having recruitment and hiring conversations.