One of the biggest headaches for companies headquartered in Europe, Asia, Central & South America, and Africa when entering the US market is Opening a US Bank Account.

Which US bank to open an account with and the application process can bewilder any seasoned business executive. To provide helpful insights on the challenges you will face and possible solutions, weConnect classifies US banks into two categories: Traditional Banks and Virtual Banks.

Traditional Banks

When we refer to Traditional Banks in the United States, we mean the big banks like JP Morgan Chase, Wells Fargo, Citibank, Bank of America, and the like. We also rope in smaller regional banks and credit unions in this category as well.

Getting an account with any of these Traditional Banks in the United States is becoming more and more challenging.

Traditional Bank Account Setup Challenges:

A. Increased Anti-Money Laundering regulations and policies

B. Meticulous checking of intended business activities

C. Confirming who ultimately benefits from such activities (called Ultimate Beneficial Owners or UBOs).

D. Physical, in-person meetings with the bank.

E. Deposits of up to and exceeding 100,000 USD

Some of these challenges can be overcome if an owner or listed officer has a social security number and residence in the United States, but this does not always guarantee you an account, though it does make the bank feel better because:

- American banks like to have someone living in the United States that they can liaise if there is ever an issue.

- They believe physical proximity to the bank increases the accountability of the responsible parties.

- American banks, as with any bank in the world, like to deal with local businesses rather than foreign businesses.

The banks might occasionally provide exceptions to their policies, depending on their risk appetite, but again the more “American” your business can be presented to the bank, the better.

Now, if you are lucky enough to even get an account with a traditional bank, the bank could change their mind at a later date because you fell outside their risk profile. The crazy part is they may never disclose the reason to you. This happened to a few of our clients headquartered in Singapore, Australia, Japan, the United Kingdom and China before we had the pleasure to work with them and sort it out.

What is the Best Approach for Setting up a US Bank Account?

So, which Traditional Bank do you even apply to? In terms of service, they are all relatively the same. They can all provide you with the deposit and money-moving services you need as banking is a commodity in the US. If you have global aspirations, it may make sense to try to set up a JP Morgan Chase or Citibank account as this will give you access to their global network of branches and make continued international expansion easier. However, if that isn’t a consideration the reality is it depends on the climate of the day. Said in another way, it is a moving target. As of writing this article in December 2022, our preferred Traditional Bank to maximize success through an introduction by weConnect would be Bank of America but if you are reading this article in 2023 or beyond, things may have changed.

Regardless, we recommend you Contact Us to help evaluate your situation and determine the best approach to getting a traditional bank in the United States of America. Additionally, weConnect can provide ongoing bank/treasury management services for clients following the opening of your US bank account. We offer the most complete and comprehensive US market entry services in the world, and our mission is to help establish our clients in the US with as few headaches as possible.

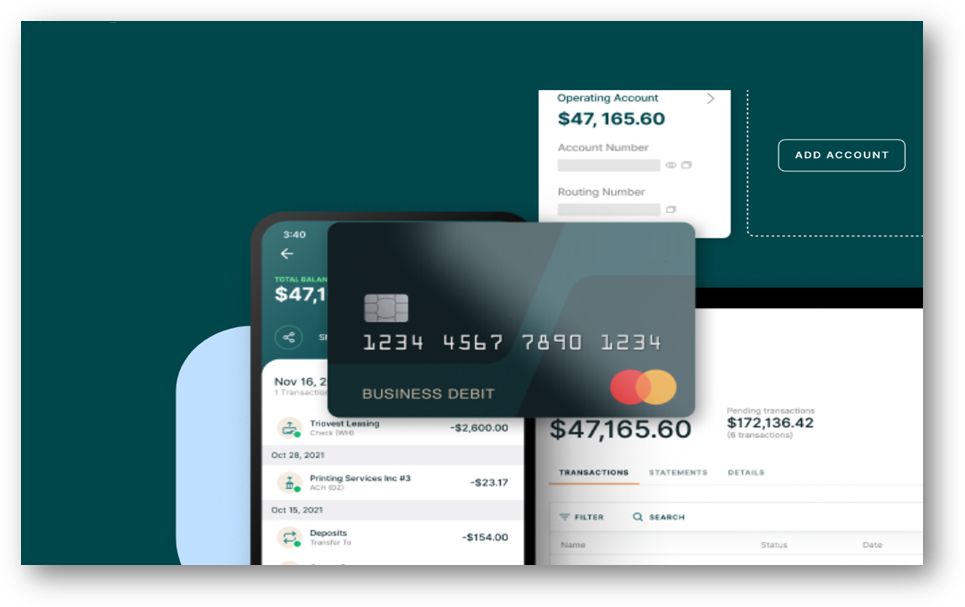

Virtual Banks

Similar to traditional banks in the United States, with most virtual banks, you can make payments and deposits via ACH, wire transfers, and checks. You would be able to issue virtual or physical debit cards as well. However, with virtual banks, there are restrictions, including limited or no access to credit facilities, savings accounts, and venture funding isn’t allowed.

Virtual bank platforms are really easy to use but can be restrictive on who can open them. Some virtual banks limit accounts to US corporations only if the owner is not residing in restricted or sanctioned countries. Also, user locations can be restricted. For example, sending international wires may be prohibited from certain countries such as North Korea, Russia, Myanmar, Iran, etc.

Unlike traditional banks, virtual banks are able to receive international funds from a few countries without additional fees. But the funds need to be maintained in USD.

Pros of using a Virtual bank include:

A. Streamlined application process with fewer Know Your Client (KYC) questions and no physical visits.

B. Accounts can be opened in a few days.

C. Operationally, they are much easier to use with

- Modern user interfaces.

- Connections with services like PayPal, Stripe or Square.

- Integrations with some accounting systems like Xero and Quickbooks.

- The ability to create multiple accounts to segregate your funds into Payroll, Tax, Operational and other categories if you so wish.

Cons of using a Virtual bank include:

A. no credit facilities

B. cannot issue credit cards, just debit cards

C. venture funding not allowed

What Is Best for Your US Subsidiary?

Virtual banks are good to get going at the start. Though to build credit, create a roadmap for easier global expansion, and gain access to U.S. venture capital, getting a traditional bank account eventually is a smart move. We suggest both for our clients as this way you can get the best of both worlds and you don’t have to manage it on your own. weConnect’s team can help make setup and ongoing management easy.

Contact us today to discuss your US banking options and other aspects of your US Market Entry.